V

Video789

Guest

Offline

Published 1/2023

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz

Language: English | Size: 2.97 GB | Duration: 4h 28m

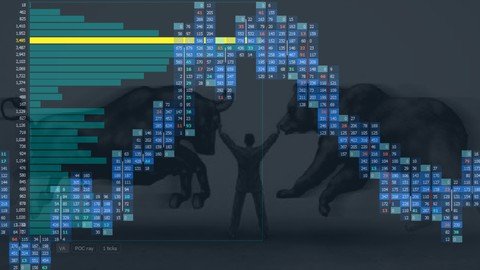

Order flow for scalping futures

What you'll learn

Why you need order flow for scalping futures?

Price / volume tools break down

Reading foot print charts and volume profile

Correlating data and reading the markets

Scalping strategies

Volume profile strategies

Requirements

No order flow prior knowledge needed.

Description

Mastering the art of scalping requires more than candles and typical indicators, that's why professionals and institutions use order flow as the main trading information resource on daily basis. as a retail trader you need to see what's behind the scenes, not just candle indicating prices going up and down, you will need to learn how prices move to gain an edge against market participants.Trading based on order flow and analyzing market volume was a game changer for me trading futures such as Nasdaq, S&P500 and Crude oil, and here I share my knowledge from years of experience.In this beginners course we will learn:+ Why you need order flow for scalping futures as an edge and method to approach markets.+ Types of orders and the mechanics of price movements.+ Price / volume tools break down such as foot print charts, time and sales, volume profile and depth of market.+ Reading foot print charts and volume profile to get better entries, confirmations and better risk managment.+ Correlating data and reading the markets.+ Scalping strategies and the short term easy money.+ Volume profile reading and strategies.+ Learn how to marry Risk managment and sizing to your trading approach to have longevity in day trading. + Day trading psychology and expectations.

Overview

Section 1: What you need to know before learning order flow

Lecture 1 Introduction

Lecture 2 Limit order vs. market orders

Lecture 3 Developing tools

Lecture 4 Data feed

Lecture 5 How prices move

Section 2: Order flow tools and indicators

Lecture 6 Why order flow is importnat

Lecture 7 Footprint chart interface

Lecture 8 Time and sales

Lecture 9 The auction and volume profile

Lecture 10 Anchor VWAP

Lecture 11 Depth of market (DOM)

Section 3: Reading foot print charts and trading strategies

Lecture 12 Market mechanics around values

Lecture 13 Reading and scalping around poc

Lecture 14 Scalping reversal

Lecture 15 The ice bergs

Lecture 16 Easy scalp (Chasing)

Section 4: Volume profile reading and strategies in focus

Lecture 17 Dry values vs liquid values

Lecture 18 Hidden values

Lecture 19 The tradeble setups around values

Lecture 20 Trade Execution

Lecture 21 Reading volume profile

Lecture 22 Volume profile day types

Lecture 23 Examples

Section 5: Sizing and risk managment

Lecture 24 Stop losses in focus

Lecture 25 Sizing

Lecture 26 Profit managment

Section 6: Trading psychology

Lecture 27 Thinking in probabilities

Lecture 28 Types of trades outcomes

Lecture 29 Markets vs. trader's edge

Lecture 30 Market cycles

This course is for all levels.

Homepage

Code:

https://www.udemy.com/course/learn-day-trading-using-order-flow-starter-course/

Fikper

Links are Interchangeable - No Password - Single Extraction